Giving to The Kansas Forest Service

Giving to The Kansas Forest Service

The Kansas Forest Service provides for the development, promotion, protection, and conservation of forest resources in Kansas. This includes both rural and community forests.

Although it is one of the nation's oldest forestry agencies, first established in 1887, Kansas Forest Service has grown and adapted to meet the needs of present-day Kansans. Kansas Forest Service has expanded in staff, programs and services offered. With that growth, comes an additional need for financial support.

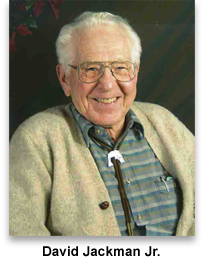

Supporing our agency helps to conserve the natural resources of our state and especially the forests, woodlands and wildlife that are the focus of our mission. Gifts may take a variety of forms such as David Jackman Jr.’s bequeath of his 950 acre estate that created the Jackman Demonstration Forest.

A gift to the Kansas Forest Service makes a difference in the lives of Kansans and ensures a bright future for Kansas ecosystems and communities. Gifts to the Kansas Forest Service are given through the Kansas State University Foundation.